Conferences, client meetings, and masterminds. There are many reasons to travel when you own your own business. And since you get to operate on your own time table that often means you can spend a few extra days exploring your destination. But when your travel includes both business and personal how do you track it to maximize your deductions and avoid an audit. Here’s how.

Defining travel deductions

Several items can be deducted when traveling for business. Make sure you’re keeping track of all your transportation, both to and from your destination and while you’re there. This can include airfare, rental cars, uber, mileage for a personal vehicle, and public transportation fare. Keep your receipts and keep a log of when and where you traveled.

Travel deductions also include lodging, 50% of your meals in 2020 and 100% of your meals in 2021/2022, and any fees associated with your convention or meetings. Again, keep all your receipts and details of what you were doing when. This is especially important because you can only deduct expenses on days that are considered business days, and only if the trip is considered primarily a business trip. So how do we determine that?

Determining Business travel vs Personal travel

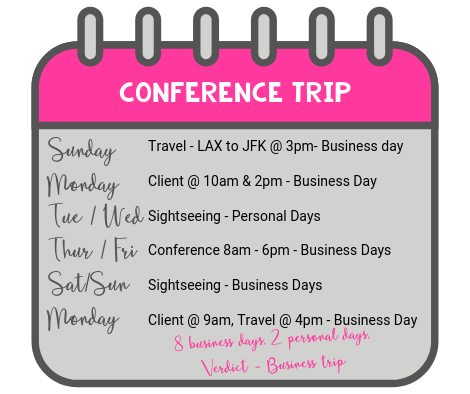

Now that we know what we can deduct in general let’s talk about whether your trip is classified as business or personal. Travel costs can be deducted if the primary purpose of your trip is business. And the determining factor of business versus pleasure is the number of days spent on each.

Travel days are considered business days, as are weekends and holidays if they fall in between workdays. You can also count on-call days as business days (days when you have to be there but you might not be called into work). And the most obvious, any days where you’re doing actual business activities. It’s important to note that you don’t have to be working the entire day, but you do need to be working during standard business hours.

If your total business days are greater than your personal days on the trip then the primary purpose of the trip is considered business and you can deduct your business expenses.

The IRS likes evidence, right?

They live on it. You must document the heck out of your trip. Keep a detailed planner or log showing what you did and when. The IRS needs to see that you had client meetings scheduled, and top it off by keeping a copy of your notes from the meeting. Get a program from the conference you are attending and keep notes to show that you attended the sessions. You have to be able to prove that your business days were really business days and that they truly outnumbered your personal days. Here’s an example.

Keep traveling, keep your notes and keep the IRS happy (or as happy as they’ll ever be...who are we kidding)

Bookkeeping seem complicated?

You know bookkeeping is vital to the success of your business. Stop procrastinating and start getting it done with this simple checklist. You’ll get:

- A list of exactly what tasks you need to do each week, month, quarter, and year so you can stay on track.

- Tax due date reminders so you stay on the IRS’s good side

- All the satisfying checkboxes so you can finally mark bookkeeping off your to do list